2015 Southern Feed & Grain Convention Forms

All forms for the 2015 SFGA Convention are now online. Download All Forms now or visit the Events Section of this website for individual forms.

All forms for the 2015 SFGA Convention are now online. Download All Forms now or visit the Events Section of this website for individual forms.

By Agrimoney.com – Published 24/06/2015

US ethanol production, which set a record last week, is poised for fresh all-time highs, as strong demand and the prospect of a “mini harvest” of corn support margins, broker Linn Group said.

An official report on Wednesday showed US ethanol production gaining 14,000 barrels a day last week to hit 994,000 barrels a day, the highest on data going back to 2010.

The rise in output came despite margins which have been pressed by the recovery in corn prices, with Chicago futures rebounding more than 5% from contract lows set in mid-June.

“We have seen production margins come down to breakeven in some areas on the fringes of the western Corn Belt,” said Jerrod Kitt at Chicago-based broker Linn Group.

Even in core areas of the eastern Corn Belt, with ready markets for the distillers’ grains feed ingredient made as a byproduct of ethanol manufacture, margins are about 10 cents a gallon, “give or take 5 cents”, he said.

‘Mini harvest’

However, Mr Kitt forecast that the rise in production was sustainable, in part thanks to the prospect of ready supplies of corn ahead, as farmers sell stocks left over from last year’s record harvest.

Mr Kitt said that “a lot of producers are sitting on a lot of corn,” with many growers holding out for higher prices, a strategy which has proved successful in many recent years.

A key US Department of Agriculture report next week is expected to show overall US corn inventories at 4.56bn bushels as of the start of this month, a rise of 18.5% year on year.

The boost to supplies as growers bring crop to market, to clear storage space for the next crop, will be akin to a “mini harvest”, with the potential for pressure on prices.

Inventories tumble

Meanwhile, demand is proving unexpectedly strong.

“The surprise about the latest ethanol data was not the rise in production but the drop in stocks,” Mr Kitt told Agrimoney.com, noting that inventories tumbled by 878,000 barrels last week to a five-month low of 19.84m barrels.

That is an unusually strong pace of decline and, coming against a backdrop of elevated production too, indicates robust demand for ethanol, which appears to be coming in part from strong exports.

“Canada is our number one export market, but others are pretty active too,” with ideas of strong shipments to the likes of North Africa and the Middle East too.

Booming market

And demand looks like remaining strong for now, with the US driving season ahead too.

“We are going to move between weeks of record production and record consumption,” Mr Kitt said.

“It is definitely going to be an exciting market, if you catch it right.”

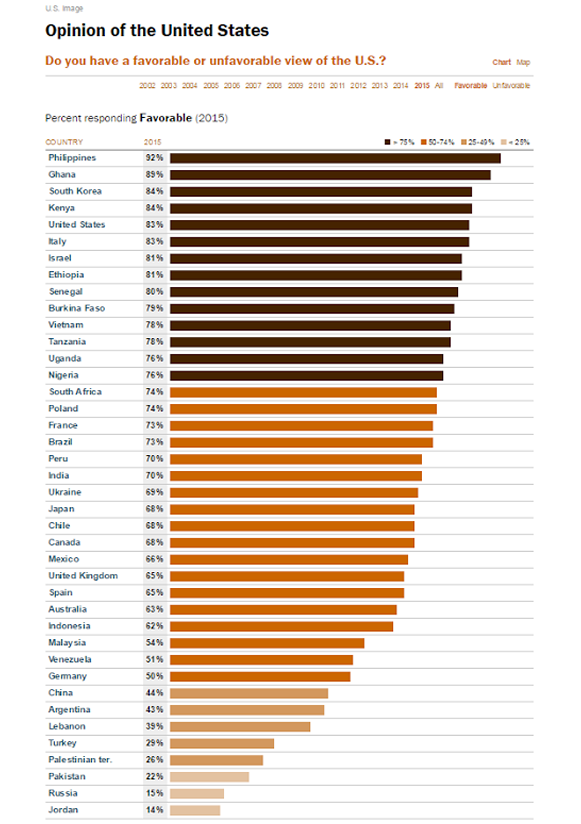

America’s overall image around the world remains largely positive. Across the nations surveyed (excluding the U.S.). A median of 69% hold a favorable opinion of the U.S., while just 24% express an unfavorable view. However, there is significant variation among regions and countries. Below are some of the specifics. To read more details and specifics please go to Pew Research.

Tuesday, June 23, 2015

Investors have become a bit more optimistic about the possibility of a Greek bailout deal being reached after EU officials actually call the country’s new budget proposals “a positive step forward.” This is a big change from sentiment expressed towards previous proposals. The European Central Bank (ECB) also offered up some relief by again raising the ceiling on emergency liquidity funds to support Greek banks, which seemed to ease the pace of bank withdrawals yesterday. The problem is I’m starting to hear more professional traders talking about a possible lose-lose scenario following a Greek and EU debt deal announcement. The theory is if EU leaders do NOT reach some-type of a compromise with Greece, the fears surrounding a banking meltdown become more of a reality and contagion across the EU becomes a more serious concern. These concerns would obviously push the U.S. dollar higher. If the EU and Greece leaders are able to ink some type of new deal, it may bring along more monetary manipulation by Draghi and the ECB. It more than likely also opens the door for the U.S. Fed to raise interest rates. Many insiders believe if the EU can avoid a meltdown with Greece and put at least a temporary bandaid on the situation or kick the can further down the road, it gives Janet Yellen and the Fed a window of opportunity to make a move an raise rates. In turn both situations, good or bad may eventually push the U.S. dollar higher and ultimately weigh on U.S. corporate earnings. Here at home today, Fed Governor Jerome Powell will be speaking on monetary policy in a Q&A format at a Wall Street Journal breakfast in Washington, D.C.. Traders will then be digesting the latest Durable Goods data and a couple of housing reports. As of this morning the U.S. dollar and the stock market are slightly higher, with crude oil steady to lower.

Brazil will export a record 27 mmt of corn in 2015, stealing U.S. market share in the process.

By Alastair Stewart

DTN South America Correspondent

SAO PAULO, Brazil (DTN) — Brazil has started harvesting a record second

corn crop and plans to place a lot of it on the international market.

Virtually perfect weather conditions over the last three months will allow

Brazilian farmers to harvest over 52.5 million metric tons in June and July, up

from 48 mmt in 2014, according to Andre Pessoa of Agroconsult, a local farm

consultancy.

The excess will be exported, causing shipments to rise from 20.1 mmt in 2014

to 27.1 mmt in 2015, creating distance between Brazil, the world’s No. 2

exporter, and the Ukraine in third place.

“Brazil now has a ready market for its corn around the world,” Pessoa told

the annual BM&FBovespa agribusiness seminar in Sao Paulo.

He forecasts the majority of the extra export market will be stolen from the U.S.

Brazilian farmers have sold a large portion of the second corn crop, some

60% in the case of Mato Grosso, mainly for export, after multinationals entered

aggressively into the market late last year.

This strategy of forward selling paid dividends this year with farmers

selling before price slid in the first half of 2015. Combined with excellent

yields, farmers in Sorriso, Mato Grosso, can expect to make some money with the

help of government subsidies in 2015 for the first time in three years.

Agroconsult estimates farmers will earn R$271 per hectare ($35.50 per acre)

in 2015 against a loss of R$99 per hectare last year.

The sharp jump in exports in August, September and October will put a strain

on ports but they should be able to cope, said Pessoa.

Expansion of export capacity through northern ports will help in this, he

noted.

Of course, most of the rest of Brazil’s second crop will be consumed by the

local poultry and pork industries, which are expanding and will consume an

extra 2 to 2.5 mmt in 2015.