Yes, We Definitely Got Milk

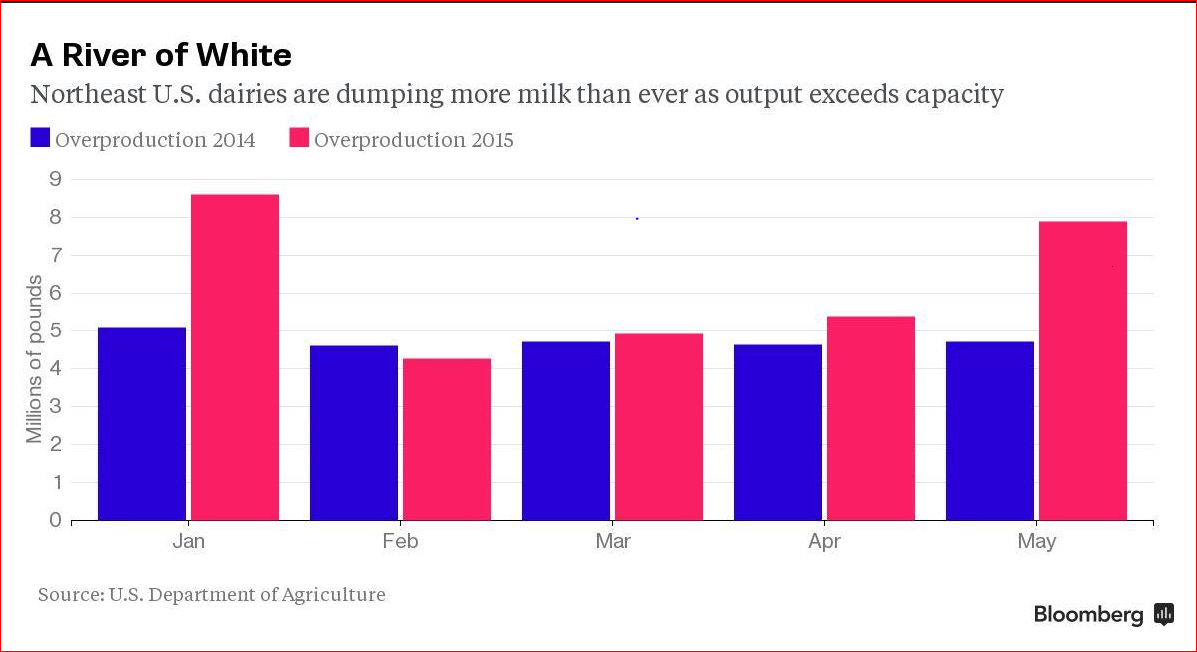

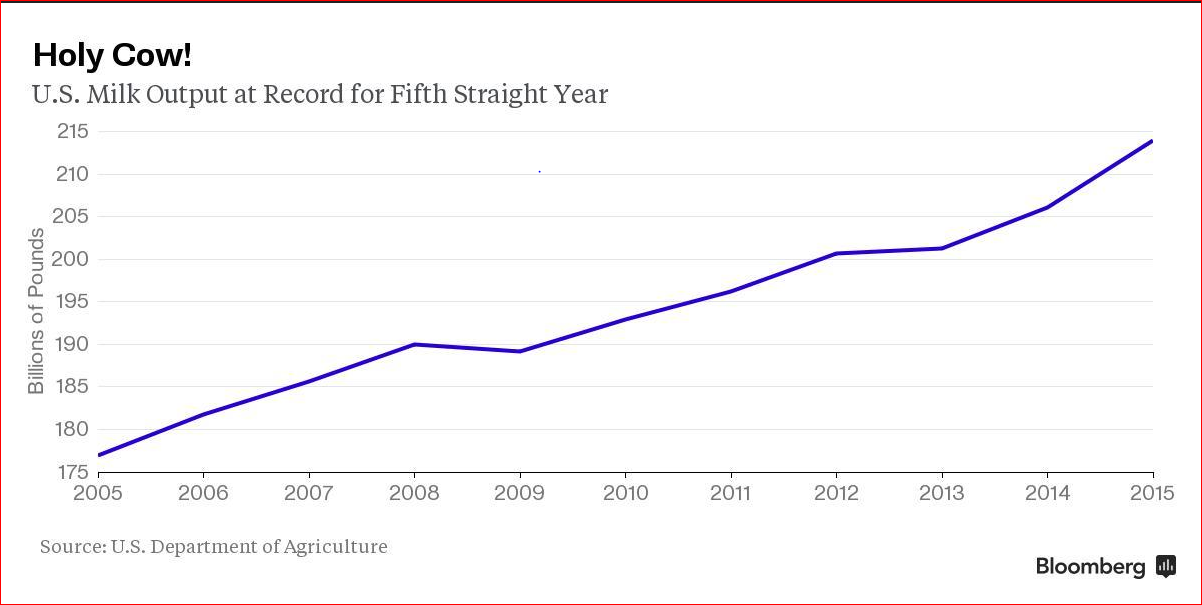

U.S. dairy cows have been busy pumping so much milk that 2016 output is expected to reach a record, according to the Department of Agriculture. Inventories are becoming burdensome at processing plants in some regions, and sellers are “struggling to find a home” for supplies, the agency said. Consumers are benefiting: they’re paying the lowest prices for retail milk in six years, government data showed Tuesday.