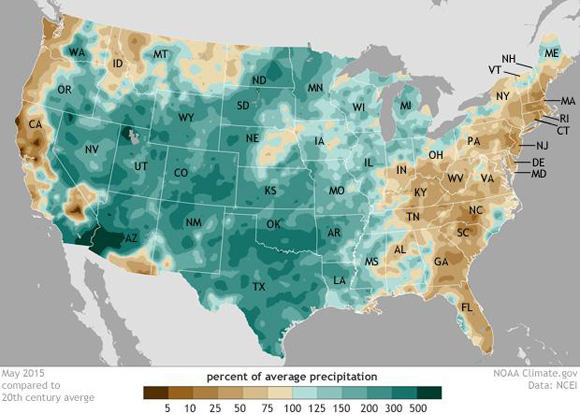

NOAA Say’s May The Wettest Month Ever For U.S.

Climate scientists at NOAA’ National Centers for Environmental Information averaged the observations of rain, snow, and other precipitation from across the country, they found out it the country’s wettest May since records began 121 years ago. In fact, it was the wettest month ever recorded! Places that were wetter than average are shades of green, while places that were drier than average are shades of brown. As you can see across much of the middle of the country, rainfall was 200-300% of average. For more information about U.S. climate conditions, including temperature and extreme weather events, visit the website of the Monitoring Branch at NOAA’s National Center for Environmental Information.