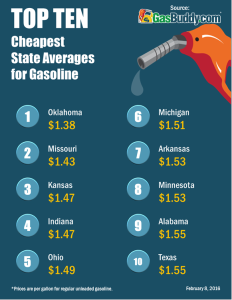

Midwest Gas Price Decline Leads Nation Average Lower

Another week, another decline at the gas pump for much of the country. Gasoline prices fell 6.2 cents in the last week, according to GasBuddy.com live data. The national average stood $1.74/gallon yesterday, some -25.6 cents lower than last month and -44.4 cents below last year’s prices. No where in the country has the decline been as large as in the Midwest, where refiners have continued to churn out cheap winter gasoline. In just the last week, average prices in Indiana, Michigan and Ohio fell 14 cents per gallon, while some stations in these states fell over -30 cents per gallon. Over half the states in the country have seen gas prices decline over -20 cents in the last month, while the Great Lakes and West Coast sit atop the list: Indiana, Illinois, Ohio and Michigan saw declines of 41-43 cents, while California, Oregon and Washington saw declines of 36-37 cents. Nationwide, just 13.1% of gas stations are selling over $2 per gallon while over 25% now are selling under $1.50 per gallon. (Source: Gas Buddy) Gas Near $1.00 Per Gallon In Some Parts Of The U.S. – There are at least eight states where some stations are now selling gas for less than $1.25 a gallon, according to GasBuddy.com. The cheapest gas at the moment is at a 7-Eleven in Oklahoma City, which is selling a gallon of regular for $1.11. In fact, more than a dozen other stations in that city have gas for $1.14 or less. Extremely cheap gas can also be found in Texas, Missouri, Ohio, Indiana, Illinois Michigan and Kansas. Nationwide, the average price of a gallon of regular is down to $1.74, the cheapest it’s been since early January 2009. Read more at CNN Money