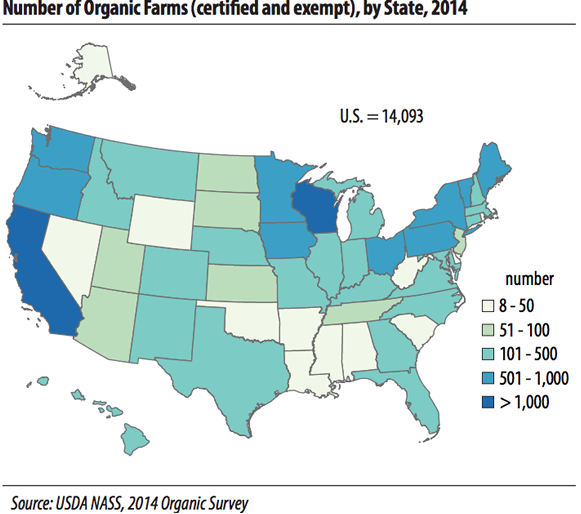

Despite Growing Demand, Organic Acreage Is Shrinking

The USDA recently released some interesting data about the state of the organic industry. It’s been well documented that demand has been rising over the past few years. Last year, more than 14,000 farms sold $5.5 billion in organic products, up +72% since the last survey conducted in 2008. Despite the seemingly booming demand though, both the number of farms and the amount of land dedicated to organic production has actually declined. There were 14,093 organic farms in the United States last year, accounting for 3.6 million acres, with another 122,175 acres in the process of becoming organic, according to the latest National Agriculture Statistics Survey. However, in 2008 there were 14,540 organic farms making up 4 million acres with another 128,476 acres going through transition. It’s not a huge reduction, but it’s definitely puzzling considering the growing size of the market. Organic sales are mostly concentrated in fruits and vegetables, along with milk and eggs. Meanwhile, producers of organic meats are struggling to boost production even as big retailers such as Target and Costco Wholesale seek to expand the number of products they offer. With about 90% of U.S. corn and soybeans production being genetically modified, those seeking organic feed are forced to turn to imports. Soybeans are the second-largest U.S. organic import following coffee, totaling $184 million last year, while organic corn imports totaled $35.7 million. Those total’s are pretty paltry in comparison to the combined $92.7 billion value of those crops grown in the U.S. last year, but there is obviously a huge supply and demand gap within our borders. The biggest problem for grain producers that may be considering switching to organic is the certification process – it’s a three year process to transition land from traditional to organic, meaning that land basically produces no revenue during that time. It will be interesting to see if falling commodity prices incentivize farmers to give organics a try. In some areas I hear organic corn has actually been trading for more than double the price of traditional corn. Whether that price incentive remains by the time you wrap up the three year transition is a big gamble.

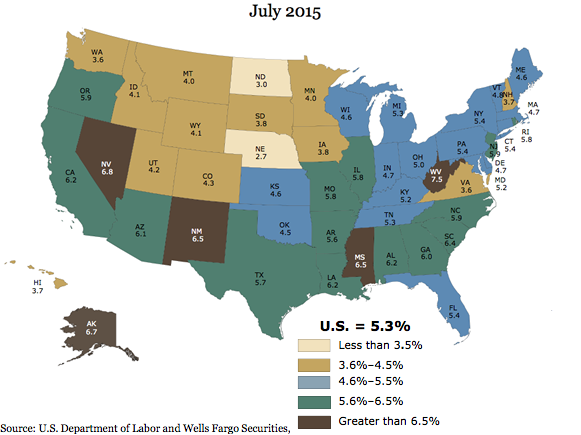

Unemployment Varies Widely Across The U.S

Wells Fargo senior economist Sam Bullard compiled this interesting map showing how varied the unemployment rate is from state to state. You can clearly see that employment runs much higher than the national rate of 5.3% across a majority of the South. Something I’ve seen a lot of economists mention lately is how the energy sector has taken the big hit and hasn’t necessarily been reflected in the unemployment numbers. Since June of last year, when oil prices started to tank, over 100,000 American workers have lost their jobs in the oil and gas industry – and those are just the jobs directly related to oil companies. This week, ConocoPhillips just announced that they are laying off 10% of their workforce and with oil prices below $50, more are likely to come. That’s going to be especially hard felt in big oil-producing states like North Dakota, Texas, Louisiana and Oklahoma.

Positive Outlook for Global Meat Market

GLOBAL – The outlook for the global meat market is largely positive, according to a joint Agricultural Outlook report from the OECD and FAO.

Current market situation

Meat prices reached record levels in 2014, driven mainly by an increasing beef price. At the same time, the Porcine Epidemic Diarrhoea virus (PEDv) in the United States and African swine fever in Europe, lowered pig meat supply in 2014 pushing pig meat prices upwards.

Sheep meat prices also increased in 2014 following several years of flock reduction in New Zealand, induced by the conversion of sheep farms to more profitable dairy operations and accentuated by drought conditions whilst substitutability among the various meats ensured firm demand and strong poultry prices.

After several years of cow herd liquidation in major producing regions, the United States bovine sector in particular started a cattle herd rebuilding phase in 2014 that sent beef prices higher.

Although herd rebuilding is expected to support beef prices in the short term, the effects of PEDv are abating and hence the price of pork and poultry should follow lower feed grain prices.

Sheep meat prices remain high along with other meats, supported by higher import demand, particularly from China for mutton and the EU for lamb, combined with flock rebuilding in Australia.

Poultry sector main beneficiary of increased consumption

The Outlook for the meat market remains largely positive, with feed grain prices set to remain low for the projection period restoring profitability in a sector that had been operating in an environment of particularly high and volatile feed costs over most of the past decade.

Production is projected to expand, as a result of increased profitability, particularly in the pig meat and poultry sectors, as well as in regions such as the Americas where feed grains are used intensively to produce meat.

However, this year’s Outlook is projecting weaker economic growth for both developed and developing countries, somewhat limiting consumption growth.

Nominal meat prices are expected to remain high throughout the outlook period, although below 2014 levels with the exception of beef which is expected to remain high for another two years, as herds are rebuilt in several parts of the world.

By 2024, prices for beef and pig meat are projected to increase to around USD 4 900/t carcass weight equivalent (c.w.e.) and USD 1 900/t c.w.e. respectively, while world sheep meat and poultry prices are expected to rise to around USD 4 350/t c.w.e. and USD 1 550/t c.w.e. respectively.

In real terms meat prices are expected to trend down from their latest high levels, although they will remain higher than in the previous decade (Figure 3.4). Global meat production rose by almost 20 per cent over the last decade, led by growth in poultry and pigmeat.

Over the next decade, global meat production will expand at a slower rate, and in 2024 will be 17 per cent higher than the base period (2012-14).

Developing countries are projected to account for the vast majority of the total increase through a more intensive […]